Looking to invest in Solana? Here's a straightforward guide to the best strategies:

- Diversify Your Portfolio: Include SOL, other Solana tokens, and even meme coins.

- Think Long-Term: Hold your investments and consider staking for growth.

- Community Engagement: Join online groups and participate in projects for insider insights.

- Continuous Learning: Stay updated on Solana and crypto trends for smart investing.

Solana's unique Proof of History and high transaction speed make it appealing for investments in dApps, NFTs, and DeFi projects. Whether you're holding long-term, actively trading, staking, or engaging with the community, understanding the risks and potential returns is key. Here's a quick comparison to help you decide:

| Strategy | Returns | Risk Level | Accessibility | Time Needed |

|---|---|---|---|---|

| Long-Term Hold | Potentially high | Moderate | Easy | Low |

| Active Trading | Potentially very high | Very high | Moderate | Very high |

| Staking | Moderate | Low/Moderate | Easy | Low |

| Community Engagement | Variable | Low/Moderate | Moderate | Flexible |

Choose a strategy that fits your risk tolerance, investment goals, and the amount of time you can dedicate. Remember, diversifying your investment within the Solana ecosystem can help mitigate risks while maximizing potential rewards.

How Proof of History Works

Proof of History helps Solana make a timeline that proves when something happened. This means Solana can do many transactions at the same time, not one after the other like most blockchains. This way, Solana can deal with 50,000 to 65,000 transactions every second, which is way more than networks like Ethereum.

PoH works with Proof of Stake to make the network safe, decentralized, and able to handle a lot of transactions. This setup lets Solana offer quick transactions that don't cost much.

Fueling Growth of Solana's Ecosystem

Because it's fast and cheap, Solana is a popular place for apps that work without a central authority (dApps), especially those about finance and unique digital items called NFTs.

By early 2022, there were more than 350 dApps on Solana, and over $11 billion locked in for finance projects. Big NFT collections like Degenerate Ape Academy and Solana Monkey Business started here too.

This growing world of apps and projects makes more people interested in Solana, which then brings even more developers. This cycle is helping Solana grow quickly.

Why Solana is Attractive for Investors

For those looking to put money into crypto, Solana is interesting because its world keeps getting bigger. As more projects start on Solana, the SOL token becomes more useful and valuable.

You can also 'stake' your SOL, which means locking it up to help keep the network secure, and you'll get rewards for doing this. Plus, if you have certain Solana NFTs, you might get special perks like invites to events or special items.

All in all, Solana's unique tech, fast-growing world, and benefits for SOL holders and NFT owners make it a good choice for long-term investment.

Comparative Analysis of Solana Investment Strategies

1. Long-term Holding

Potential Returns

If you decide to keep your SOL and other tokens for a long time, you could make a lot of money if Solana keeps growing fast. As more projects start using Solana, more people will want SOL, which could make its price go up. If you're patient, you might see your investment grow a lot, maybe even 5 to 10 times, over more than five years.

Risk Level

Holding onto your tokens for a long time can be a bit risky. The price of crypto can go up and down a lot in the short term, so you need to be okay with seeing the value of your investment drop before it goes up again. Solana could also face challenges from other technologies or government rules.

Accessibility

You can buy SOL and other tokens from Solana on big crypto exchanges like Coinbase, Binance.US, Kraken, and KuCoin. It's pretty easy to buy and keep these tokens. You can also make some extra money by 'staking' your SOL, which means locking it up for a while to help keep the network safe and getting rewards in return.

Time Investment

When you invest for the long term, you don't have to spend a lot of time managing your investments. Just check on them now and then. But, it's still a good idea to keep up with what's happening with Solana, look into new chances to make money, and understand how staking and DeFi can give you more returns.

2. Active Trading

Potential Returns

Buying and selling Solana, its tokens, and NFTs quickly can lead to big wins, but it's not easy. If you know what you're doing, you can make a lot of money by catching the right moments to buy and sell. But, if you're new or make mistakes, you might end up losing cash instead of making it.

Risk Level

Trading is super risky because the prices of cryptocurrencies can jump up or down very fast. If you're not careful, you might buy something at a high price and then have to sell it at a lower price, losing money. Plus, paying fees for each trade can eat into what you earn.

Accessibility

To start trading, you'll need to sign up with exchanges like Coinbase Exchange, Kraken, Binance.US, or KuCoin. These are places where you can buy and sell. But, you also need to keep a close eye on prices and news so you can make smart moves.

Time Investment

Trading takes a lot of time. You have to watch the market closely, study price charts, and keep up with news that could affect prices. This means spending several hours every day just focusing on your trades, trying to buy low and sell high.

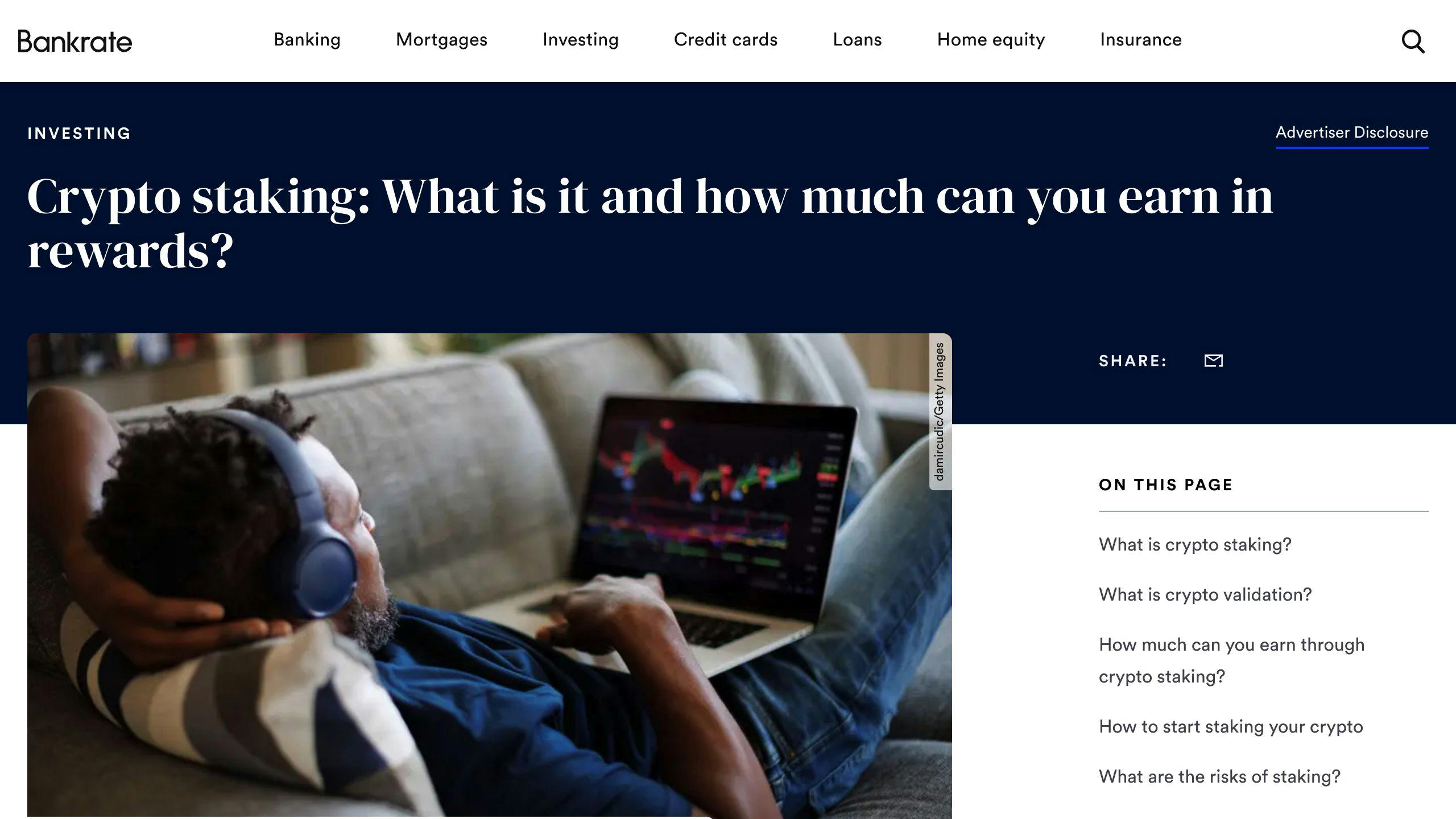

3. Staking

Potential Returns

When you stake your SOL tokens, you can get back about 5-7% of what you put in every year. So, if you stake 100 SOL, you'll earn around 5 to 7 SOL as a reward each year. The more you stake, the more you get back. Staking is a way to earn money that's less risky than quick buying and selling, and it gives you a nice amount back over time.

Risk Level

Staking is pretty safe compared to fast trading. Your staked SOL is locked in, so its price going up or down quickly doesn't affect it much. The biggest risk is if something really bad happens to the whole Solana system, but that's not very likely because Solana is growing fast. If you keep your SOL staked, even when its price drops, you'll likely be fine.

Accessibility

You can stake SOL easily on places like Kraken, Binance.US, and KuCoin, or through Solana wallets like Phantom, Solflare, and Sollet. Just move your SOL to your wallet, pick a validator (someone who helps the network run smoothly), and let them know you want to stake. Most wallets make this pretty straightforward.

Time Investment

After you've staked your SOL, there's not much to do but let it sit and earn rewards. You might want to check in now and then to see if you should stake your rewards again or pick a different validator, but this doesn't take much time. You'll probably spend about 30 minutes a month keeping an eye on your stake.

4. Community Engagement

Potential Returns

Joining the Solana community can help you find new ways to make your investment grow. You might get early news about projects, free tokens, invites to special events, and more. It's tough to say exactly how much you can gain, but being active in the community often leads to both making money and making friends.

Risk Level

Being part of the community is pretty safe when it comes to risks. Just be smart about avoiding scams and don't pour money into projects without doing your homework first. Hanging out with other crypto fans might tempt you to take bigger chances or trade more than you planned.

Accessibility

Getting involved with the Solana folks online is straightforward. Check out the Solana subreddit, Discord channels, and Twitter for starters. There are also meetups in many big cities. Diving deeper into specific projects requires more effort but could pay off more.

Time Investment

How much time you spend is up to you. You could just spend a few minutes each day catching up on news or dive in for hours, helping out with projects or organizing meetups. The more time you put in, the more you're likely to get out of it.

Long-term Holding vs. Active Trading

When we compare holding onto your Solana investments for a long time versus trading them often, here's how they stack up:

| Strategy | Potential Returns | Risk Level | Accessibility | Time Investment |

|---|---|---|---|---|

| Long-term Holding | You could make a lot more money if the Solana world keeps growing. Think 5-10 times your money in over 5 years. | There's some risk because prices can go up and down, but it's not as risky as trading all the time. | It's pretty easy to start. Just buy some Solana tokens and keep them safe. | You don't need to spend much time. Just buy and check on them once in a while. |

| Active Trading | You can make a lot quickly if you're good at knowing when to buy and sell. But, you can also lose a lot fast. | This is very risky because crypto prices can change a lot in a short time. | You need to use the bigger exchanges that let you make quick trades. There's a lot to learn. | This takes a lot of time. You need to watch the market closely every day. |

What's the big difference?

-

Returns: Holding on to your investment could give you a big payoff over time, but it takes patience. Trading can give you quick wins but also big losses.

-

Risk: Holding is generally safer than trading. Trading is very risky and needs a lot of know-how.

-

Accessibility: Starting with holding is easier. Trading needs you to learn more and use more advanced exchanges.

-

Time: If you're holding, you just set it and forget it for the most part. Trading needs your constant attention.

So, holding onto your Solana investments is a simpler, less risky way to possibly make a lot over time. Trading offers the chance for quick money but comes with high risk and needs a lot of effort. Your choice should depend on what you're comfortable with, how much risk you can take, and how much time you want to spend on it.

Staking in the Solana Ecosystem

Staking your SOL tokens means you're helping to keep the network safe and in return, you get some rewards. As more people join the Solana world, it's good to know how staking can give you benefits and what risks are involved.

Overview of Staking Rewards

When you stake your SOL, you're basically lending them to people called validators, who make sure transactions on the blockchain are legit. In exchange, they share some of their earnings with you. You can usually expect to get back about 5-7% a year.

How much you earn depends on a few things:

- How much SOL everyone is staking

- How busy the network is

- The deal you have with your validator

Even if the network gets super busy and rewards go down, the value of SOL itself might go up, which is good for you.

Risk Considerations

Staking is pretty steady, but there are some risks like:

- Market swings: The value of your rewards and SOL can go up and down a lot.

- Tech troubles: If there's a problem with the blockchain or your validator messes up, you might not get rewards for a bit.

- Slashing: If your validator does something wrong, you could lose some of your staked SOL. This doesn't happen often, especially if you choose a good validator.

Optimizing Staking Strategies

Here's how to make the most out of staking:

- Choose reliable validators to reduce the risk of losing SOL.

- Lock up your SOL for longer to get more rewards.

- Keep staking your rewards to earn more over time.

- Spread your SOL across different validators to lower risk.

- Pull out your SOL slowly if its value starts to drop, to avoid bigger losses.

Conclusion

Staking SOL is a smart way to earn extra while helping the Solana network stay strong. Keeping up with the Solana community helps you stay informed about changes that might affect your staking. It's all about finding a balance between helping the network and growing your investment, depending on what you're comfortable with and how long you're planning to invest.

Diversification Within the Solana Ecosystem

Spreading out your investments in different areas can help lower risk and increase potential rewards in the Solana world. Here's how:

Participate in Solana's Thriving DeFi Sector

- DeFi platforms on Solana like Serum, Solend, and Francium let you lend, borrow, and earn interest without going through traditional banks.

- By putting some of your money into well-known Solana DeFi projects, you can spread your investments and maybe see them grow as Solana's DeFi space gets bigger.

- The more the Solana DeFi world grows, the more useful and valuable SOL and other related tokens might become.

Invest in Emerging Solana NFT Projects

- NFTs on Solana, like Degenerate Ape Academy and SolPunks, are becoming popular. Buying and selling these digital items is a new way to invest.

- Always do your homework before buying NFTs to make sure the project is solid. Watching sales can also help you figure out what they might be worth later.

- While it's risky, getting in early on good NFT projects can give you a chance to make money in new areas of Solana.

Allocate Funds to Meme Coins

- You could also put a little bit of your investment into meme coins like Solana Inu or Samoyed Coin. These can sometimes make a lot of money, but they're very unpredictable.

- Only invest what you're okay with possibly losing in meme coins because they can change in value a lot.

- Putting money into several meme coin projects can help lower your risk. Keep an eye on how active and developed each meme coin's community is.

By putting your money into different places like DeFi, NFTs, and meme coins, you can keep your risk lower while still trying for big rewards in the Solana ecosystem.

sbb-itb-cfd3141

Community Engagement and Project Participation

Getting really involved in the Solana community and its projects can be a smart way to invest. By jumping in early on promising projects, you can get special insights, opportunities, and even access to new things.

Identifying Early Stage Projects

The trick is to spot good projects when they're just starting. Look for them in places like:

- Solana forums and Discord chats

- Telegram groups for new projects

- The Solana subreddit

- Solana's Twitter community

When you're checking out a project, remember to:

- Look into who's behind the project and their past successes

- Understand what the project is about and how it plans to succeed

- See how well they talk to their community and share their plans

Putting money into projects early is riskier but can lead to big wins.

Leveraging Community Wisdom

Being active in the community lets you find out about:

- Announcements of new projects

- Q&A sessions with the project teams

- Help and advice

- What people think and what's trending

- Tips for making more from staking

Talking and listening to the community helps you make smarter choices.

Contributing to the Network

Helping projects do well helps the whole Solana network grow, which can make your investments more valuable. You can help by:

- Giving feedback to developers

- Talking about projects online

- Making guides or videos

- Hosting or helping with events

Helping out now could lead to rewards and a say in things later on.

Conclusion

Being part of the Solana community gives you a front-row seat to its growth. Finding and backing projects early on can really pay off. And beyond just making money, your active involvement helps make Solana stronger.

Evaluating Risks and Rewards

When you're thinking about putting your money into crypto, like Solana, it's super important to look at what could go right and what could go wrong. Here's a simple breakdown to help you think it through:

Assessing Inherent Market Volatility

- Crypto prices can jump up and down a lot. This means you could make money quickly, but you could also lose it just as fast. Make sure you're okay with the ups and downs before you dive in.

- It's smart to do your homework and get a feel for how much the price of something like SOL or other tokens might change.

Reviewing Project Fundamentals

- It's like looking under the hood of a car before you buy it. Check out who's running the show, if they have a strong community, what their tech is like, and if they have a clear plan for the future.

- Go for projects that have more than just buzz. They should have a real purpose and a solid team.

Analyzing Staking and Lending Protocols

- There are risks like bugs in the code, new laws, or big market drops that could affect how much you earn from lending out your crypto or staking it.

- Look at different places where you can stake or lend your crypto and see which ones have been reliable in the past.

Evaluating Early-Stage Investment

- Putting money into a brand-new project can lead to big wins, but it's also riskier. Make sure to check out the team, their plan, and how excited people are about it before you jump in.

- Starting with just a little bit of money might be a good idea until you see the project making real progress.

Key Takeaways

- Investing in crypto always comes with some risk, but doing your research can help you make smarter choices.

- Looking at the basics of a project can give you a safer bet than just going with the hype.

- When it comes to earning from staking or lending, pick your spots carefully.

- Early investments can pay off big, but they're not without their dangers.

Understanding the balance between risk and reward, especially in the fast-moving world of crypto like the Solana ecosystem, is key. Keeping an eye on the long-term and not just the quick wins can help you make the most of your investments.

Pros and Cons

Here's a quick look at the good and bad sides of different ways to invest in Solana:

Long-Term Holding

Pros

- You might make a lot of money if Solana keeps growing quickly.

- It's less risky than trying to make quick trades.

- It's easy to start: just buy some tokens and hold onto them.

- You don't need to spend a lot of time on it after you buy.

Cons

- You need to be patient to see big returns.

- You're still at risk if prices go up and down a lot.

- There might be tech issues that could mess with how much you make from staking.

Active Trading

Pros

- You could make money fast if you're good at picking the right times to buy and sell.

- You can quickly respond to changes in the market.

Cons

- There's a really high risk because crypto prices can change a lot very fast.

- You need to keep a close eye on the market all the time.

- If you don't time your trades right, you could lose money.

- The fees from trading a lot can add up and cut into your profits.

Staking

Pros

- You can earn a steady return, about 5-7% a year, just for holding your tokens.

- It's safer than making a lot of trades.

- It's easy to start with staking your tokens on exchanges.

Cons

- How much you make can change over time.

- Tech problems could stop you from getting your rewards.

- If the validator you choose does something wrong, you might lose some of your staked tokens.

Community Engagement

Pros

- You can find out about new chances and get rewards for being involved.

- Being active helps make the Solana network stronger.

Cons

- You need to put in time to be really involved.

- There's still a risk of running into scams.

Comparative Analysis

| Strategy | Returns | Risk Level | Accessibility | Time Needed |

|---|---|---|---|---|

| Long-Term Hold | Potentially high | Moderate | Easy | Low |

| Active Trading | Potentially very high | Very high | Moderate | Very high |

| Staking | Moderate | Low/Moderate | Easy | Low |

| Community Engagement | Variable | Low/Moderate | Moderate | Flexible |

To sum it up, while trading a lot can give you the chance for big, quick profits, it also means a lot of work and big risks. Holding onto your Solana for a long time can bring in good money with less risk and effort. Staking gives you a steady income. And getting involved with the community can offer different kinds of rewards and ways to help out.

Conclusion

When we talk about the best ways to invest in Solana, it's all about finding what works for you. You need to think about how much risk you're okay with, what your goals are, and how much time you can put in.

Here's a quick look at the main strategies we talked about:

Long-Term Holding

- Returns: You could make a lot if Solana keeps getting more popular

- Risk: You have to be okay with prices going up and down

- Accessibility: Easy to start

- Time: You don't need to spend much time on it

This is a good way to start if you're new. Just buy some SOL or other tokens related to Solana and hold onto them. If Solana keeps growing, you could see a nice return. But remember, prices can change quickly, so you have to be patient.

Active Trading

- Returns: You can make a lot quickly if you know what you're doing

- Risk: Very high because prices change fast

- Accessibility: You need to learn a bit before starting

- Time: Takes a lot of time

This is for people who really know crypto and can spend a lot of time on it. You can make money fast, but it's easy to lose money too. You'll need to be on top of things all the time.

Staking

- Returns: A steady income of around 5-7% a year

- Risk: Not too risky

- Accessibility: Easy to start

- Time: Doesn't take much time

Staking means you lock up some of your tokens to help keep the network secure, and you get some money in return. It's a good way to make a little extra without doing much. Just make sure you pick the right places to stake.

Community Engagement

- Returns: It varies

- Risk: Not too risky

- Accessibility: Takes some effort to get really involved

- Time: Up to you

Getting involved in the Solana community can be rewarding. You might find out about new projects early or get special opportunities. It takes some time, but it's a great way to learn more and maybe even make some money.

In Closing

- Think about what you're looking for and choose a strategy that fits.

- Don't put all your eggs in one basket. Try different things to spread out the risk.

- Always do your homework before you put money into something.

- Keep learning about crypto because things change fast.

Solana is an exciting place with lots of opportunities. But remember, being smart and careful with how you invest is the key to doing well.

Related Questions

Is Solana still a good investment?

Solana has grown a lot in 2023, more than 10 times its lowest value. It's hard to say what will happen next, but Solana has some strong points:

- It's really good at handling lots of transactions quickly and cheaply, which keeps bringing in more people and projects.

- More and more big projects choose Solana, making its community and ecosystem bigger.

- Big investors are starting to put money into Solana and other cryptocurrencies.

But, there are some risks, like new rules from governments or big price changes. Always remember to only invest what you're okay with possibly losing. For those who believe in the future of cryptocurrencies, Solana is still an exciting option.

Who should I stake my Solana with?

When you're looking to stake your Solana, here are a few validators that are worth considering:

- StakeHaus - Offers high rewards and charges low fees. They're known for their top-notch systems.

- Everstake - Also known for high rewards and low fees.

- Blockdaemon - They're very secure and reliable, good for those who want peace of mind.

It's a good idea to spread your Solana across a few different validators. This way, you lower your risk. Look at their history, how much they charge, what they're good at, and what other people say about them.

How can I make money from Solana?

Besides just keeping SOL, here are some ways you can earn money with Solana:

- Staking - You can get steady rewards, usually between 5-7% a year, for helping to secure the network.

- Yield farming - You can lend your crypto on platforms like Raydium and earn interest.

- NFT trading - Buy and sell digital art and collectibles on Solana, like those from Degenerate Ape Academy.

- Airdrops - Sometimes, you can get free tokens just for being active in the Solana community.

What is the highest potential for Solana?

Predictions vary, but some think Solana could be worth over $200 each in the next five years. This could happen because of:

- A growing number of DeFi (decentralized finance) and NFT projects on Solana.

- More businesses starting to use Solana.

- More regular people getting into crypto.

- Solana's ability to handle lots of transactions, making it useful worldwide.

Remember, cryptocurrency prices can go up and down a lot, so thinking about the long-term can help smooth out those bumps.